JP Morgan was the latest, on Tuesday — reiterating its “Overwieght” rating and a $52 price target. But JP Morgan is at the upper edge of what the other major bankers expect.

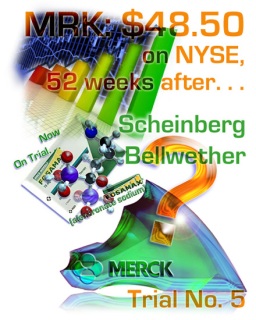

In any event, this sort of defense of Merck is what I had in mind last night — because a $42 handle is near the bottom of fair value for New Merck, in these current market conditions. [I didn’t want anyone reading too much into the latest back and ‘fro in the Scheingberg Fosamax® ONJ Bellwether trial.]

Do go read all of this — but here’s a bit:

. . . .Eleven equities research analysts have rated the stock with a buy rating, three have issued an overweight rating, and eight have given a hold rating to the company’s stock. The company has a consensus rating of “overweight” and a consensus target price of $48.47. . . .

I think that’s about right — the bolded bit above sounds about right for fair value, 52 weeks from today. I think Merck (and Pfizer, as well) are poised to benefit, on balance, from health care reform in the US — and I see currencies moderating, as a drag on revenue, for both companies. We shall see.